pa estate tax exemption

The Homestead Exemption saves property owners thousands of dollars each year. PA-33 fillable PA-33 print Statement of Qualification - Life EstateTrusts must be filed with PA-29 PA-35 fillable PA-35 print Assessing Officials Response to ExemptionsTax CreditsDeferral Application.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Real Estate Tax Millages.

. This deed is a written instrument conveying an interest in property for which an exemption is claimed under section 7cc of the general property tax act 1893 PA 206 MCL 2117cc and the state equalized valuation of that property is equal to or lesser than the state equalized valuation on the date of purchase or on the date of acquisition by the seller or transferor for that same. 1921-1932 or 15 Pa. PA-1 -- Online Use Tax Return.

4 The need for the exemption from the payment of real estate taxes has been determined by the Commission. REV-330 -- Electronic Filing Guide for Business Taxpayers. Suite 900 Pittsburgh PA 15219 Ph.

Force a sheriff sale. Form 2705 L-4258 Real Estate Transfer Tax Valuation. Free Pennsylvania Property Tax Records Search.

County Blue Book Supply Catolog. The County Board for the Assessment and Revision of Taxes will grant the tax exemption. County - 473 mills.

To record with an exemption use a Realty Statement of Value Transfer Tax Form REV-183 from the Pennsylvania Department of Revenue. Court Appeal Notification List. Attach a copy of the articles of consolidation merger or division.

Exemption Being Claimed Under PA 330 of 1993 as Amended Amount of SRETT Refund Requested State Tax Only. Do not jeopardize your Homestead by renting your property. The tax office is no longer accepting cash payments.

Find Pennsylvania residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Blue Book Order Form. This means that with the right legal maneuvering a married couple can protect up to 2236 million after both spouses have died.

Maintain or obtain an out-of-state residency based tax exemption reduction benefit credit etc. PA-30 Elderly and Disabled Tax Deferral Application. Tax on transfer to P10000 Tax on lease to X-8000.

2 transferred to members of the same family of the decedent. This exemption is portable. Other When claiming an exemption other than those list-ed you must specify what exemption is claimed.

Estate transfer tax stamp affixed by the county Register of Deeds. 866-539-1100 Keystone Collections Group has opened a new phone. 546 Wendel Road Irwin PA 15642 Ph.

Being a homeowner in Pennsylvania can qualify you for another property tax relief programthe state property tax reduction allocation. A sells the real estate subject to Xs lease to P for 1 million. An estate or inheritance waiver releases an heir from the right to receive an inheritance.

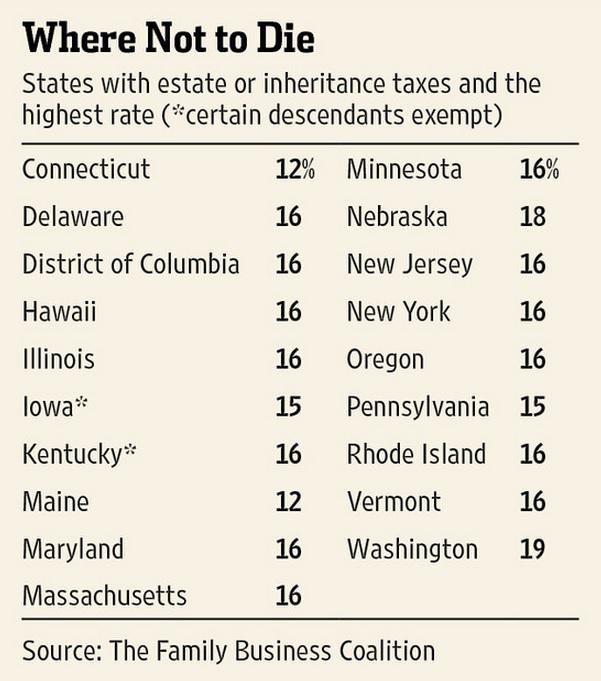

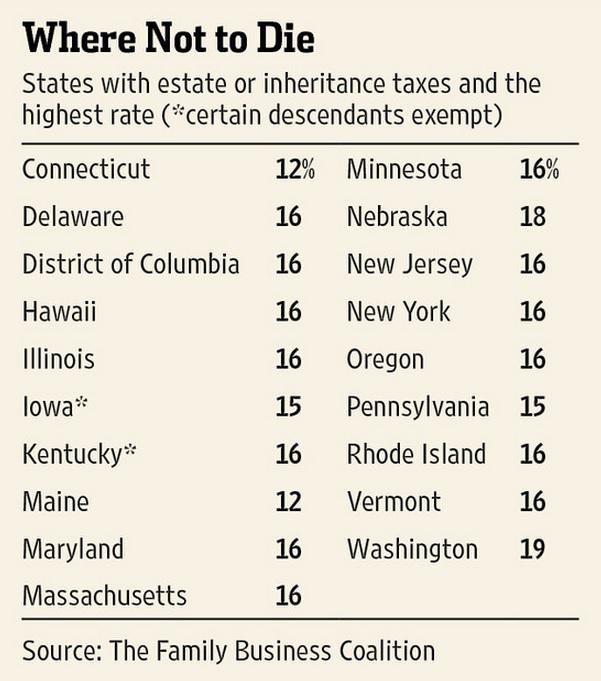

In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. Find location and zoning information. Apply for a grant to clear your.

E-911 Notice -- E-911 Surcharge - Notice of Tax Change for 2011. STAR in NY a veterans exemption the Massachusetts declaration of homestead etc This requirement applies to jointly held property by husband and wife even if only one applies for homestead here and the other applies for the out-of-state tax credit. PA-29 Permanent Application for Property Tax CreditExemptions.

A leases real estate to X for a 50-year term and tax is paid in the amount of 8000. Get a real estate tax adjustment after a catastrophic loss. Foreclosure sheriff sales.

REV-227 -- Pennsylvania Sales and Use Tax Credit Chart. 5951-5957 is exempt from tax. A trust for the sole benefit of members of the same family will also qualify.

The exemption certificate should be properly executed given to the vendor within sixty days of purchase and should contain the following statement. REV-221 -- Sales and Use Tax Rates. Copy of the claimants.

3 continue to be devoted to the. The law governing the waiver varies by state. Tax to be paid to recorder on transfer to P2000.

No estate will have to pay estate tax from Pennsylvania. An official receipt from the county treasurer 2. 2019 Exemption.

Venango County Parcel Viewer. Personal checks submitted in this period will. Bids Proposals Quotes.

It is a PA-funded homestead exclusion that lowers taxable values across the state but the exact amounts are set by counties. Exemption from inheritance tax. Payment of real estate taxes.

Office Basics Interactive Catalog. The computation of the tax is as follows. Ra-retxpagov Please do not send completed applications or personally identifiable.

As of January 1 2012 the exclusion equaled the federal estate tax applicable exclusion amount so long as the FET exclusion was not less than 2000000 and not more than 3500000. REV-183 EX All Pennsylvania Counties Common Level Ratio CLR Real Estate Valuation Factors - This lists the current common level ratio factors as of July 1. Please visit the Tax Collectors website directly for additional information.

Save your home from mortgage and tax foreclosure. PA-33 Statement of Qualification - Life EstateTrusts must be filed with PA-29. 1 The appropriate board of the assessment and revision of taxes or other similar board for the assessment of taxes determines that.

5921-5930 or the statutory division of a nonprofit corporation 15 Pa. Sheriff. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill.

B The unmarried surviving spouse of a veteran qualifies for the real property tax exemption if. Hotel Tax Matrix -- Hotel Tax Matrix. Application for Homestead and Farmstead Exemption PDF.

1 devoted to the business of agriculture at the time of the decedents death. PA Property Tax Relief for All Homeowners. PA-35 Assessing Officials Response to ExemptionsTax CreditsDeferral Application.

There is still a federal estate tax. Property or services qualify as building machinery and equipment and will be transferred pursuant to a construction contract to name of tax-exempt entity and if an institution of purely public charity holding Sales Tax. December 15 th thru december 31 st we will only accept bank checksmoney orders for payment of the taxes.

Earned Income Local Services Taxes Earned income and local services taxes are collected by Keystone Collections. Affidavit validated by the county Register of Deeds. The Homestead Exemption saves property owners thousands of dollars each year.

Blue Book Order Adjustment Form. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. Get a nonprofit real estate tax exemption.

PA-100 -- Pennsylvania Online Business Entity Registration. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022. PA-30 fillable PA-30 print Elderly and Disabled Tax Deferral Application.

Tax Collection Real Estate Taxes. Please visit the Tax Collectors website directly for additional information. Find a licensed contractor and contractor information.

Physical Address View Map 1168 Liberty Street Courthouse Basement Franklin PA 16323 Directions. The realty transfer tax is 2 percent. 724-731-2300 School - 2030 mills.

We will accept personal checks money orders until december 15 th. If you are in this category. Before buying real estate property be aware that non-ad valorem assessments may have a significant impact on your property tax bill.

In order to qualify for the business of agriculture exemption real estate must be. Permanent Application for Property Tax CreditExemptions. Do not jeopardize your Homestead by renting your property.

Checks should be made payable to abington township tax collector. Robert Walter Chief Assessor. Office Basics Returns Pick-Up.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

A Comparison Of The Pennsylvania And New Jersey Inheritance Tax Laws

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Input Tax Credit Under Gst Section 16 To 21 Rules 36 To 45

Inheritance Tax How It Works How Much It Is Bankrate

The Death Tax Taxes On Death American Legislative Exchange Council

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)